The Bank of Mum and Dad has made gifts and loans of nearly £9 billion over the last year, according to property firm, Savills. The figure represents an increase in excess of 50% since the beginning of the pandemic.

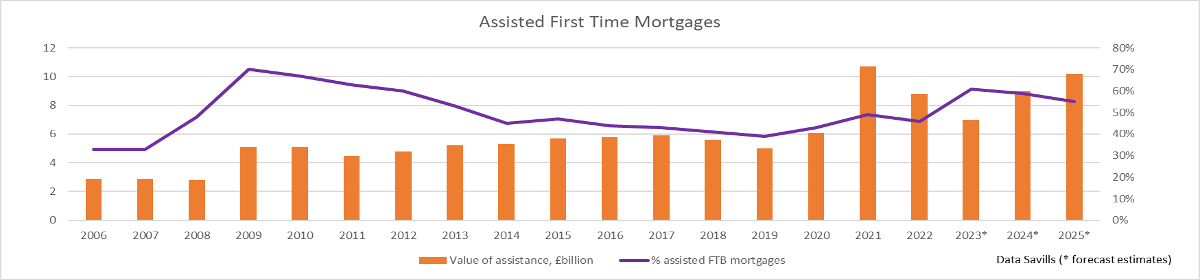

In 2022, 170,000 first time buyers secured a mortgage with financial assistance from family members, down from 198,000 the previous year. The figure represents around 46% of first time buyers purchasing property with a mortgage.

The Nationwide’s latest figures show that average house prices in the UK have increased by 19% since the pandemic started and now stand at £257,000. First time buyers have the increased problems of the end of the Help to Buy scheme, increased interest rates, affordability issues and higher deposits. All this at a time when rents and the cost of living are increasing rapidly.

The average two year mortgage rate for a fixed term loan of 90% was 5.38% in February 2023.

This year, the figures are expected to be even higher, and may possibly equate to three in five property purchasers receiving help from family to buy into the property market, while the number of transactions is expected to reduce to levels seen before the pandemic.

Savills estimates that over 335,000 first time buyers have received help from Help to Buy since the scheme was introduced in 2013, which has provided over £11 billion of support to help first time buyers. The scheme is now due to end and there is currently no replacement in sight.

The deadline for first time buyers to register an application under the Help to Buy scheme was 31st October 2022. No new applications have been accepted since that time and, to receive help, the exchange and legal completion must happen by the scheme deadline, which was initially 31st March 2023. For those granted an extension, ‘Eligible Dwellings’ (homes which have an NHBC Building Warranty or other equivalent Building Warranty approved by Homes England) have until 31st May 2023 to legally complete.